The fitness industry has seen a rapid growth in the recent few years. While some fitness trends faded out, some have managed to survive the passage of time and some others underwent a transformation.

Let’s take a look at how the Fitness Industry has performed over the last couple of years and what keeps it thriving despite changing customer preferences.

Global Fitness Industry – Analysis

According to the latest International, Health, Racquet and Sportsclub Association (IHRSA) report, the global fitness industry earned an estimated USD 94 billion in 2018, from USD 87.2 billion in 2017.

The industry is growing at a rate of 8.7 percent in terms of revenue and is likely to continue at the same rate, with a potential of reaching USD 106 billion in 2020.

In terms of fitness markets, some markets performed well in 2018, with the USA projecting a higher growth compared to others.

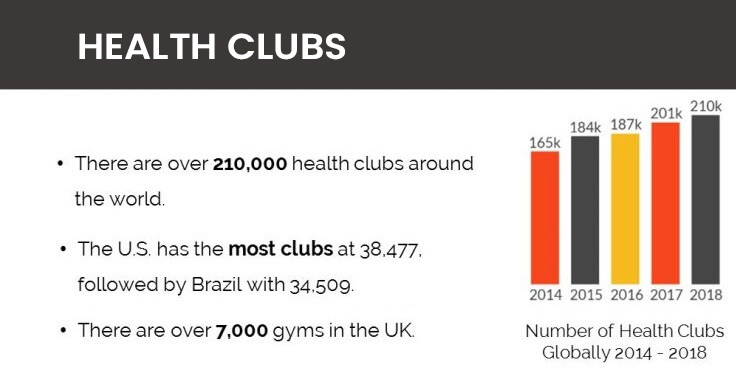

The number of health clubs increased to 210,000 clubs worldwide, hosting close to 183 million members. However, this number does not include boutique studios, community recreation facilities and gyms located in setups such as hotels.

Fitness Trends – An Overview

Coming to fitness trends, some of them that have remained strong over the years and will continue to maintain their presence in the future as well. This includes functional training, HIIT and a steady drift towards holistic wellness.

However, the rise of technology has also paved way for some ‘digital trends’ which include on-demand fitness services (where individuals train with fitness equipment and receive expert guidance at the same time), mobile fitness applications and fitness wearables.

Millennials have been identified as the most desirous of such trends as proved by a Nielsen study that found 81 percent millennials perform exercise or like to perform exercises.

“For Millennials, wellness is a daily, active pursuit. They’re exercising more, eating smarter, and smoking less than previous generations… And this is one space where they’re willing to spend money on compelling brands,” observed Goldman Sachs.

Within millennials, women are the more dominant group in terms of fitness application usage, displaying double the usage of such applications by men. While 46 percent want as many insights as possible into their health, 54 percent are drawn to buying a body-analyzing device.

Fitness Industry – Growth Markets

Asia still has to go a long way in terms of growth of its fitness industry, despite rapid expansion and increased flow of investments.

Especially, the Indian fitness industry is seeing the entrance of many fitness players, who are however failing to convert their investments to revenue. The fitness industry in the Indian market displays a penetration of 0.12 percent, despite a presence of 3,800 clubs.

Meanwhile in China, the fitness industry is displaying rapid growth, which is visible in the establishment and popularity of boutique studios.

Considering the pace at which the fitness industry is expanding in the Chinese market, fitness brands should tap on this opportunity as soon as they can.

The Chinese fitness industry boasts of more than 2700 traditional health clubs and increasing studio-style establishments, with increased growth opportunities available in tier-three and four cities.

In Europe, the IRHSA observes that Poland, Russia and Turkey have a huge potential for growth of the fitness industry.

Meanwhile in the Middle East, North Africa and Latin America have been identified as regions with potential development opportunities.

Fitness Trends – Boutiques, Health Clubs and Equipment

- Boutiques

The increase of boutique studios continues to be visible through 2019 and beyond. Their ability to serve a niche clientele makes them a popular choice among Millennials, who prefer personalized training and unique fitness experiences. Even though their memberships cost 2-4 times more than health clubs, their higher-margin operating model is alluring even to fitness entrepreneurs and investors, especially in China.

- Health Clubs

The US market has the most number of health clubs – 38,477, followed by Brazil with 34,509 and 7,000 + gyms in the UK.

- Fitness Equipment

In terms of fitness equipment, this industry continues to show a steady growth with stiff competition among big players to establish dominance. While cardio and strength machines continue to maintain their presence, there’s an unignorable rise and expansion of functional training equipment.

While there is a high demand for the equipment industry to cater to, there still lies a question on how they’ll adapt to the expansion of the boutique studio industry which mobilizes limited equipment.

Approximately 30% of studios spend less than USD 1000 on equipment per year, with 65% spending less than USD 5000. – The Association of Fitness Studios.

Summary

The fitness industry is emerging as a solution not only to many millennials various fitness needs but is also solving many health issues including cardiovascular disease and obesity.

While millennials drive the growth of this industry, there is also the boomers group who have a lot of health benefits to reap from the fitness industry. Therefore, fitness entrepreneurs should align their business plans to serve this generation as well.

Download Fitness App- Why am I always hungry? Reasons to Find Out Why?

- What are the benefits of walking barefoot?

- How to Keep a Balanced Diet While Travelling

- No-Excuses Workout Training